Unlock Your Car’s Potential: Texas Bonded Title Explained

Owning a vehicle in Texas comes with a certain level of freedom and responsibility. But what happens when you find yourself in a situation where you lack the proper paperwork, specifically the title? This is where the Texas bonded title comes into play, offering a crucial pathway to legally owning and operating your vehicle. This article will delve into the intricacies of obtaining a Texas bonded title, providing a comprehensive guide to help you navigate the process.

The journey to obtaining a Texas bonded title can seem daunting, but understanding the requirements and procedures is the first step towards reclaiming your vehicle’s potential. This guide will break down the process, offering clarity and direction for those facing this common challenge. This is a critical process for anyone seeking to legally own a car in Texas without a standard title. Let’s unlock the mysteries surrounding the Texas bonded title.

Understanding the Texas Bonded Title

A Texas bonded title, also known as a Certificate of Title with Bond, is a legal document issued by the Texas Department of Motor Vehicles (TxDMV). It serves as proof of ownership for a vehicle when the standard title cannot be obtained. This situation often arises when the original title is lost, stolen, or never provided by a previous owner. The key difference between a regular title and a bonded title lies in the requirement of a surety bond.

The surety bond is a financial guarantee that protects the state of Texas and any potential previous owners from financial loss if someone later claims ownership of the vehicle. This bond acts as insurance, ensuring that any legitimate claims can be addressed. This is a crucial component of the process, and understanding its function is key to unlocking your car’s potential.

When is a Bonded Title Needed in Texas?

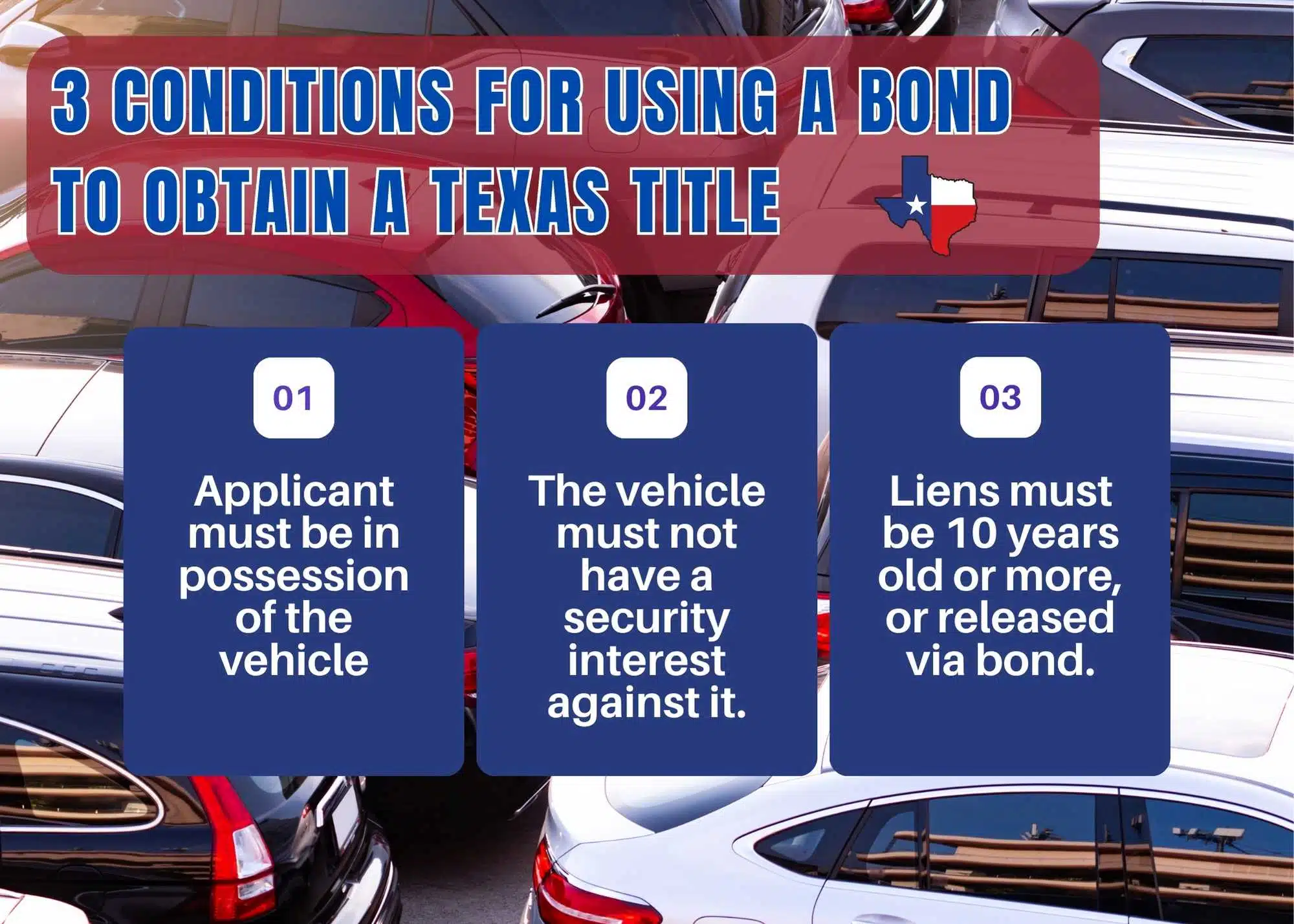

Several circumstances necessitate the need for a Texas bonded title. The most common scenario involves the inability to provide the original vehicle title. This can occur due to several reasons, including:

- Lost Title: The original title has been misplaced or cannot be located.

- Missing Title: The seller failed to provide the title during the vehicle purchase.

- Out-of-State Title Issues: Problems with titles from other states.

- Vehicle Abandonment: Acquiring a vehicle that was abandoned on your property.

Essentially, if you cannot present a clear and valid title to the TxDMV, a bonded title becomes your pathway to legal ownership. The need for a Texas bonded title often arises unexpectedly, highlighting the importance of understanding the requirements and procedures.

The Process: Obtaining a Texas Bonded Title

Obtaining a Texas bonded title involves a series of steps. Each step is crucial to ensure compliance with state regulations. Here’s a breakdown of the process:

- Vehicle Inspection: The vehicle must undergo a safety inspection and, if applicable, an emissions inspection. This ensures the vehicle meets the state’s safety standards.

- Vehicle Identification Number (VIN) Verification: A VIN inspection is required to verify the vehicle’s identification number and ensure it matches the records. This helps to prevent theft and fraud.

- Title Search: The TxDMV conducts a title search to determine if there are any existing liens or ownership disputes on the vehicle.

- Application for Bonded Title: Complete and submit the necessary application form (Form VTR-130) to the TxDMV. This form requires detailed information about the vehicle and the reason for the missing title.

- Surety Bond: Obtain a surety bond from a licensed Texas surety bond company. The bond amount is determined by the vehicle’s value. The bond protects the state and any previous owners from potential claims. This is a critical step in unlocking your car’s potential.

- Submit Documentation: Provide all required documentation to the TxDMV, including the application, inspection reports, VIN verification, and surety bond.

- Waiting Period: The TxDMV will review the application and supporting documents. A waiting period, typically 30 days, is required to allow for any potential claims against the vehicle.

- Title Issuance: If no claims are made during the waiting period, the TxDMV will issue a Texas bonded title. This title will be marked as a “Bonded Title.”

- Converting to a Regular Title: After three years, if no claims have been filed against the vehicle, you can apply to convert the bonded title to a regular Texas title.

The process can seem complex, but following these steps carefully will guide you towards legally owning your vehicle. Remember, the Texas bonded title unlocks your car’s potential.

Key Requirements and Documentation

Successfully obtaining a Texas bonded title relies on providing the correct documentation. Gathering the necessary paperwork is an important step in unlocking your car’s potential. Be prepared to provide the following:

- Application for Texas Bonded Title (Form VTR-130): This is the primary application form.

- Vehicle Inspection Report: Proof that the vehicle has passed a safety inspection.

- VIN Verification Form: Completed by a TxDMV-certified inspector.

- Surety Bond: Obtained from a licensed Texas surety bond company. The bond amount is determined by the vehicle’s value.

- Bill of Sale (if applicable): Documentation of the vehicle purchase.

- Proof of Ownership (if available): Any documentation that supports your claim of ownership, such as a previous title or registration.

- Identification: Valid driver’s license or other acceptable forms of identification.

Gathering the correct documentation upfront will streamline the application process and increase your chances of success. The Texas bonded title process is significantly easier when you are prepared.

Finding a Surety Bond Company

A crucial step in obtaining a Texas bonded title is securing a surety bond. Several licensed surety bond companies in Texas offer these bonds. Choosing the right company is important. Here’s what to consider:

- Licensed in Texas: Ensure the company is licensed to operate in Texas.

- Competitive Rates: Compare quotes from different companies to find the best rates.

- Reputation: Research the company’s reputation and reviews.

- Customer Service: Choose a company with responsive customer service.

The surety bond amount is typically based on the vehicle’s current market value. The bond protects the state and any previous owners from potential claims on the vehicle. Selecting a reputable surety bond company is a key part of the process of obtaining a Texas bonded title and unlocking your car’s potential.

Cost Considerations

Obtaining a Texas bonded title involves several costs. Understanding these costs is crucial for budgeting. Be prepared for the following expenses:

- Vehicle Inspection Fees: The cost of the safety and emissions inspections.

- VIN Verification Fee: The fee for the VIN inspection.

- Surety Bond Premium: The cost of the surety bond, which varies based on the vehicle’s value.

- Application Fee: The fee charged by the TxDMV for processing the application.

- Title Fee: The fee for issuing the Texas bonded title.

The total cost will vary depending on the vehicle’s value and the fees charged by various service providers. Planning for these expenses will help you navigate the process smoothly and unlock your car’s potential.

Potential Challenges and Solutions

While the process of obtaining a Texas bonded title is straightforward, some challenges may arise. Being aware of these potential hurdles and their solutions can help you overcome them:

- Finding the Right Documentation: If you lack certain documents, such as a bill of sale, try to obtain them from the previous owner or search for alternative documentation.

- Determining the Vehicle’s Value: Accurately determining the vehicle’s value for the surety bond can be challenging. Use resources like Kelley Blue Book or consult with a vehicle appraiser.

- Title Search Results: If the title search reveals liens or ownership disputes, you will need to resolve these issues before obtaining a bonded title. This may require legal assistance.

- Waiting Period: The 30-day waiting period can be frustrating. Be patient and ensure all your paperwork is in order to avoid delays.

Addressing these potential challenges proactively will help you navigate the process and ultimately unlock your car’s potential with a Texas bonded title.

The Benefits of a Texas Bonded Title

Obtaining a Texas bonded title offers several significant benefits to vehicle owners:

- Legal Ownership: The bonded title provides legal proof of ownership, allowing you to register and operate the vehicle legally.

- Vehicle Use: You can legally drive and use your vehicle.

- Vehicle Sale: Once you have a bonded title, you can sell the vehicle.

- Peace of Mind: It provides peace of mind, knowing that you have legally secured ownership of your vehicle.

The Texas bonded title is a crucial step in reclaiming your vehicle’s potential. It is a legal document that offers clear advantages to vehicle owners. The benefits are clear: legal ownership, vehicle use, and peace of mind. The Texas bonded title unlocks your car’s potential.

Conclusion

Obtaining a Texas bonded title can seem daunting, but with a clear understanding of the process, requirements, and potential challenges, it is achievable. This guide has provided a comprehensive overview, from understanding the need for a bonded title to navigating the application process. By following these steps, you can unlock your car’s potential and legally own and operate your vehicle in Texas. The Texas bonded title offers a pathway to legal ownership, ensuring that you can enjoy the freedom of the road. The Texas bonded title is a vital tool for those facing title issues.

Remember to gather all necessary documentation, secure a surety bond, and follow the TxDMV’s guidelines. With patience and persistence, you can successfully obtain your Texas bonded title and regain control of your vehicle. The Texas bonded title is the key to unlocking your car’s potential.

[See also: How to Transfer a Car Title in Texas]

[See also: Texas Vehicle Registration Requirements]

[See also: What to Do if Your Car Title is Lost]