Tax Day 2024 Countdown: Are You Ready? Your Ultimate Guide to Filing

The clock is ticking! As we approach Tax Day 2024, the pressure mounts for millions of Americans. Whether you’re a seasoned filer or a first-timer, the complexities of the US tax system can be daunting. This comprehensive guide will serve as your roadmap, providing essential information, practical tips, and a clear understanding of what you need to do to navigate the Tax Day 2024 deadline successfully. Let’s break down everything you need to know to ensure you’re prepared and ready to file.

Understanding the Tax Day 2024 Deadline

The standard Tax Day 2024 deadline for filing your federal income tax return and paying any taxes owed is April 15th. However, this date can shift due to weekends or holidays. Keep a close eye on official IRS announcements, as they will confirm the exact date. It’s crucial to mark this deadline on your calendar and plan accordingly. Procrastination can lead to penalties and interest, so early preparation is key.

Who Needs to File?

Generally, if your gross income meets or exceeds a certain threshold, you are required to file a federal income tax return. The specific threshold varies based on your filing status (single, married filing jointly, head of household, etc.), age, and other factors. The IRS provides detailed guidelines on its website, outlining the income requirements for the Tax Day 2024 filing season.

Even if your income is below the filing threshold, you may still want to file. This is particularly true if you are eligible for tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit. Filing a return is the only way to claim these credits and potentially receive a refund.

Gathering Your Tax Documents

Before you can start filing, you need to gather all the necessary tax documents. This includes:

- W-2 Forms: Received from your employer(s), reporting your wages and taxes withheld.

- 1099 Forms: Reporting various types of income, such as interest, dividends, and self-employment income. Common 1099 forms include 1099-INT (interest income), 1099-DIV (dividends), and 1099-NEC (nonemployee compensation).

- 1095 Forms: Reporting health insurance coverage.

- Records of Deductible Expenses: This could include receipts for charitable donations, medical expenses, student loan interest, and other eligible deductions.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): For yourself, your spouse (if applicable), and any dependents.

Organizing these documents in advance will streamline the filing process and help you avoid last-minute scrambling as Tax Day 2024 approaches. Consider using a dedicated tax folder or digital storage system to keep everything organized.

Choosing Your Filing Method

You have several options for filing your taxes:

- Tax Software: Many user-friendly tax software programs are available, offering step-by-step guidance and automated calculations. Popular options include TurboTax, H&R Block, and TaxAct. These programs typically offer different versions based on your filing complexity and income level.

- Tax Professional: If you have a complex tax situation, consider hiring a tax professional, such as a Certified Public Accountant (CPA) or an Enrolled Agent (EA). They can provide personalized advice and ensure you are taking advantage of all eligible deductions and credits.

- IRS Free File: If your income falls below a certain threshold, you may be eligible to use the IRS Free File program. This program offers free tax preparation and filing options through various tax software providers.

- Paper Filing: While still an option, paper filing can significantly delay your refund. The IRS encourages taxpayers to file electronically for faster processing.

The best method for you will depend on your individual circumstances. Research your options and choose the method that best suits your needs.

Understanding Tax Deductions and Credits

Tax deductions and credits can significantly reduce your tax liability. It’s important to understand the differences between them:

- Deductions: Reduce your taxable income, which in turn lowers the amount of tax you owe. Common deductions include the standard deduction, itemized deductions (such as medical expenses, state and local taxes, and charitable donations), and above-the-line deductions (such as student loan interest and contributions to a traditional IRA).

- Credits: Directly reduce the amount of tax you owe. Credits are generally more valuable than deductions because they provide a dollar-for-dollar reduction in your tax liability. Common tax credits include the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Tax Credit.

Make sure you explore all available deductions and credits to maximize your tax savings. Tax software and tax professionals can help you identify and claim these benefits.

Common Tax Forms You Should Know

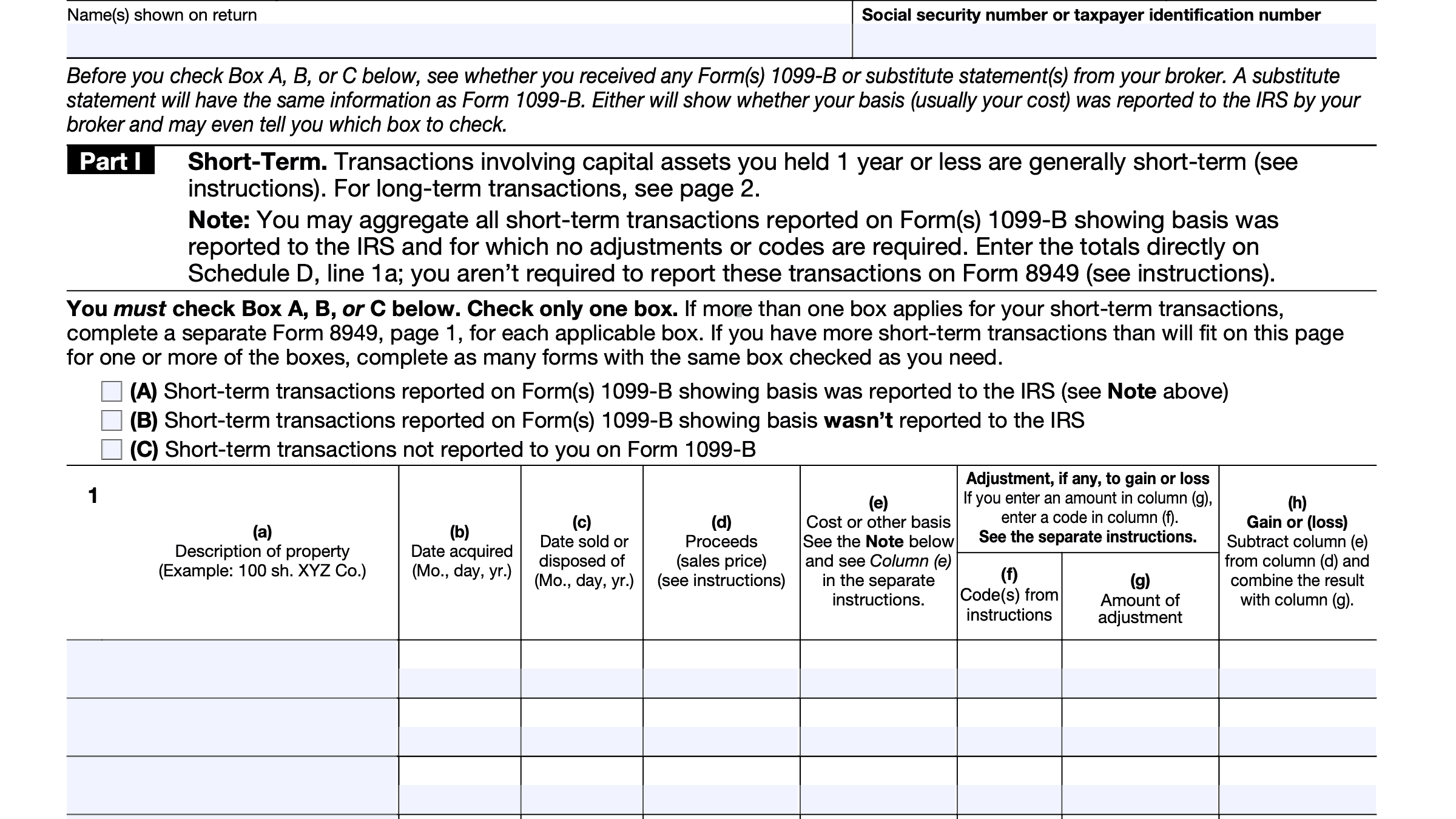

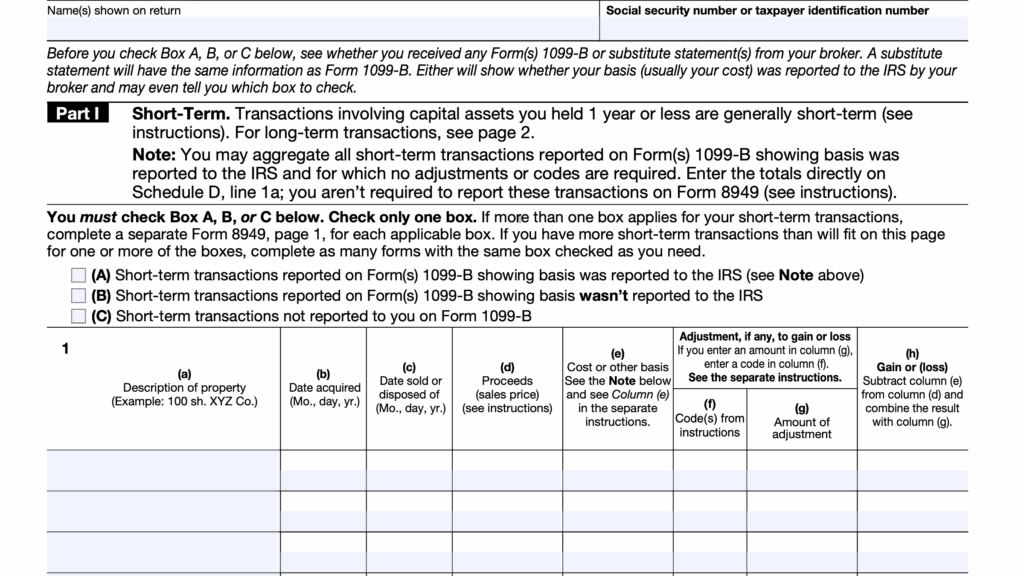

Familiarizing yourself with common tax forms can make the filing process smoother. Here are some important forms to be aware of:

- Form 1040: The main tax form used to file your federal income tax return.

- Schedule 1 (Form 1040): Used to report additional income and adjustments to income.

- Schedule A (Form 1040): Used to itemize deductions.

- Schedule SE (Form 1040): Used to calculate self-employment tax.

- Form W-2: Wage and Tax Statement, provided by your employer.

- Form 1099-NEC: Used to report nonemployee compensation.

- Form 1099-INT: Used to report interest income.

- Form 1099-DIV: Used to report dividend income.

The IRS website provides detailed instructions for each form. Having a basic understanding of these forms can help you navigate the filing process with greater confidence.

Filing Electronically vs. Paper Filing

The IRS strongly encourages electronic filing (e-filing). E-filing offers several advantages:

- Faster Refunds: Electronic returns are processed much faster than paper returns. You can typically receive your refund within a few weeks if you file electronically and choose direct deposit.

- Accuracy: Tax software and e-filing systems can help reduce errors, as they automatically perform calculations and check for common mistakes.

- Security: E-filing systems use secure methods to protect your personal and financial information.

- Confirmation: You will receive confirmation that the IRS has received your return.

While paper filing is still an option, it can lead to delays in processing and refund issuance. E-filing is generally the preferred method for Tax Day 2024.

Avoiding Common Tax Mistakes

Many tax errors are easily avoidable. Here are some common mistakes to watch out for:

- Incorrect Social Security Numbers: Double-check that you have entered the correct SSNs for yourself, your spouse, and any dependents.

- Math Errors: Tax software can help minimize math errors, but it’s still essential to review your return carefully.

- Missing Information: Make sure you have included all required information, such as your income, deductions, and credits.

- Filing Too Late: Avoid the stress of last-minute filing by starting early and gathering your tax documents in advance of Tax Day 2024.

- Incorrect Bank Account Information: If you are receiving a refund via direct deposit, verify that you have entered the correct bank account and routing numbers.

Taking the time to review your return carefully and using tax software or a tax professional can help you avoid these common mistakes.

What to Do If You Cannot File on Time

If you are unable to file your tax return by the Tax Day 2024 deadline, you can request an extension. Filing for an extension gives you additional time to file your return, but it does not extend the deadline for paying your taxes. You must still estimate your tax liability and pay any taxes owed by the original deadline to avoid penalties and interest.

You can request an extension by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, with the IRS. The extension gives you until October 15th to file your return. Remember, this is an extension to file, not an extension to pay.

Tax Planning for the Future

Tax planning is not just a once-a-year activity. By taking a proactive approach to tax planning throughout the year, you can potentially reduce your tax liability and make the filing process easier. Consider these strategies:

- Keep Accurate Records: Maintain organized records of your income and expenses throughout the year.

- Adjust Your Withholding: If you are an employee, review your W-4 form and adjust your tax withholding to ensure you are not overpaying or underpaying your taxes.

- Contribute to Retirement Accounts: Contributions to tax-advantaged retirement accounts, such as a 401(k) or IRA, can reduce your taxable income.

- Track Potential Deductions: Keep track of potential deductions, such as charitable donations, medical expenses, and business expenses.

- Consult with a Tax Professional: Consider consulting with a tax professional for personalized tax planning advice.

By implementing these strategies, you can improve your financial well-being and minimize your tax burden in the years to come, making Tax Day 2024 and beyond a less stressful experience.

The Importance of Staying Informed about Tax Law Changes

Tax laws are constantly evolving. Staying informed about the latest changes is crucial to ensure you are filing correctly and taking advantage of all available tax benefits. The IRS website is an excellent resource for the latest updates and guidance.

Key areas to watch for include changes to tax brackets, deductions, credits, and filing requirements. Tax software and tax professionals can also help you stay abreast of these changes.

Understanding the impact of these changes on your tax situation is essential for accurate filing and effective tax planning in preparation for Tax Day 2024.

Final Thoughts: Preparing for Tax Day 2024

Preparing for Tax Day 2024 doesn’t have to be a source of anxiety. By following the steps outlined in this guide, gathering your documents, choosing the appropriate filing method, and taking advantage of available deductions and credits, you can approach tax season with confidence. Remember to stay organized, file on time, and stay informed about the latest tax law changes. Good luck, and happy filing!

[See also: Tax Filing Checklist, Tax Credits and Deductions, Understanding Tax Forms]