Is Your LLC Stable? A Self-Assessment & Improvement Guide

The Limited Liability Company (LLC) has become the cornerstone of small business ownership in the United States. Offering a blend of liability protection and operational flexibility, it’s an attractive structure for entrepreneurs across various industries. But the allure of an LLC can sometimes overshadow the crucial need for ongoing assessment. Simply forming an LLC isn’t enough; its long-term stability hinges on proactive management and a keen understanding of its inner workings. This guide provides a comprehensive self-assessment and improvement plan to help LLC owners determine if their business is truly stable and sustainable.

The core question is: Is your LLC stable? This isn’t just about avoiding lawsuits; it’s about ensuring your business can weather economic storms, adapt to changing market conditions, and ultimately, thrive. This article will delve into key areas to evaluate, providing practical steps you can take to fortify your LLC and position it for long-term success. We’ll cover financial health, legal compliance, operational efficiency, and more. This self-assessment guide is designed to be a practical resource, not just a theoretical exercise.

Financial Health: The Lifeblood of Your LLC

Financial stability is paramount. A failing business, regardless of its legal structure, will ultimately fail. Assessing your LLC’s financial health involves more than just looking at your bank balance. It requires a deep dive into your financial statements and a clear understanding of your business’s financial performance. Here’s what to consider:

- Profitability: Are you generating consistent profits? Analyze your income statement to track revenue, expenses, and net profit over time. Look for trends and identify areas where you can improve profitability. A sustained loss is a significant red flag.

- Cash Flow: Positive cash flow is essential for meeting your obligations. Track your cash inflows and outflows. Are you able to pay your bills on time? Do you have enough cash on hand to cover unexpected expenses? Poor cash flow management is a common cause of business failure.

- Debt Management: How much debt does your LLC carry? Assess your debt-to-equity ratio and ensure you’re not over-leveraged. High debt levels can make it difficult to weather economic downturns. Are you managing debt effectively and meeting your repayment schedules?

- Budgeting and Forecasting: Do you have a budget and regularly forecast your financial performance? Budgeting helps you track your spending and identify potential problems early on. Forecasting allows you to anticipate future challenges and opportunities.

- Key Financial Ratios: Familiarize yourself with key financial ratios, such as gross profit margin, net profit margin, and current ratio. These ratios provide valuable insights into your LLC’s financial health and can be compared to industry benchmarks.

If you identify weaknesses in any of these areas, it’s crucial to take corrective action. This might involve cutting expenses, increasing revenue, renegotiating debt terms, or seeking professional financial advice. Remember, a healthy financial foundation is crucial for your LLC’s stability.

Legal Compliance: Staying on the Right Side of the Law

Maintaining legal compliance is non-negotiable for any LLC. Failing to comply with relevant laws and regulations can expose your business to significant risks, including fines, lawsuits, and even the loss of your business. This section will help you assess your LLC’s compliance status:

- Registered Agent: Is your registered agent current and accessible? Your registered agent is the designated point of contact for official legal and government correspondence.

- Annual Filings: Are you up-to-date with your annual reports and other required filings with the state? Missing deadlines can lead to penalties and the potential for your LLC to be administratively dissolved.

- Tax Compliance: Are you meeting all your tax obligations, including federal, state, and local taxes? This involves filing tax returns accurately and on time and paying all taxes owed.

- Contracts and Agreements: Review your contracts and agreements to ensure they are legally sound and protect your interests. Consult with an attorney to review any contracts you are unsure about.

- Employment Law: If you have employees, are you complying with all employment laws, including wage and hour laws, anti-discrimination laws, and workplace safety regulations?

- Intellectual Property: Are you protecting your intellectual property, such as trademarks, copyrights, and patents?

Non-compliance can be costly. If you’re unsure about any aspect of legal compliance, consult with an attorney. Regularly review your legal obligations to ensure your LLC remains in good standing. This is another crucial aspect of your LLC’s stability.

Operational Efficiency: Streamlining Your Business

Operational efficiency is about doing more with less. It’s about optimizing your business processes to reduce costs, improve productivity, and enhance customer satisfaction. Here’s how to assess your LLC’s operational efficiency:

- Process Mapping: Map out your key business processes to identify bottlenecks and inefficiencies. This can involve creating flowcharts or other visual representations of your processes.

- Technology Utilization: Are you leveraging technology to automate tasks and improve efficiency? Explore software solutions for accounting, customer relationship management (CRM), project management, and other areas.

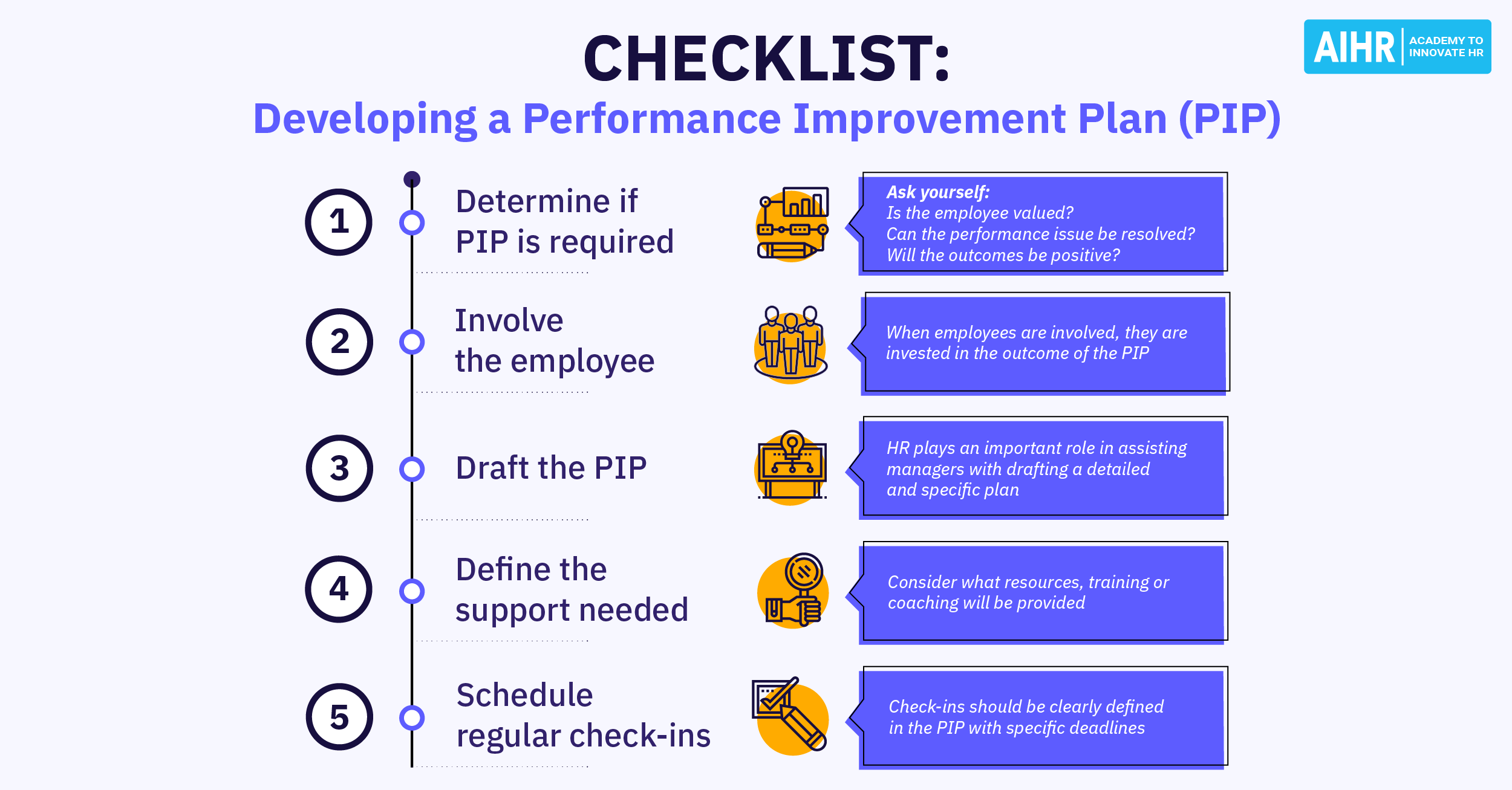

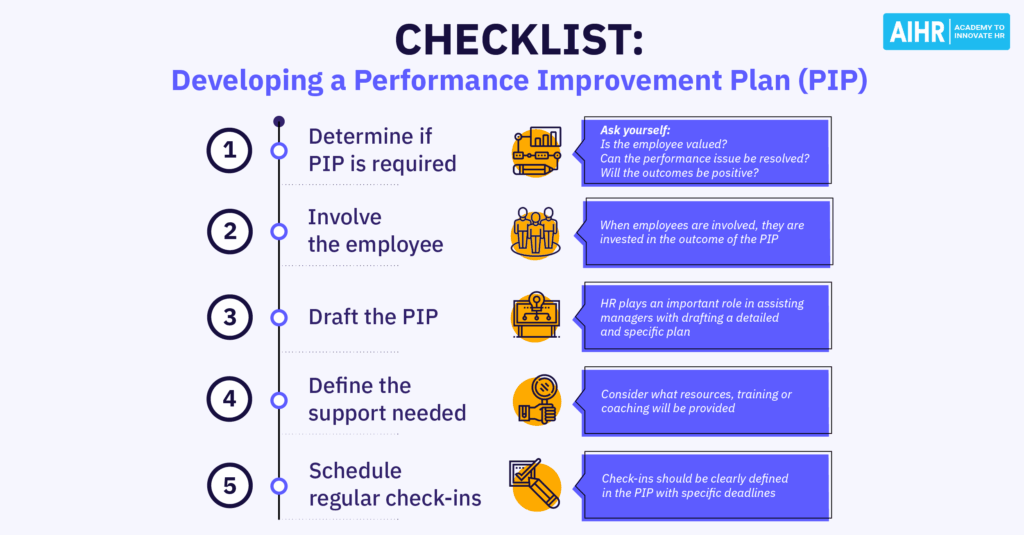

- Employee Productivity: Are your employees productive and engaged? Provide adequate training and support. Implement performance management systems to track employee performance and identify areas for improvement.

- Supply Chain Management: If you have a supply chain, is it efficient and cost-effective? Evaluate your relationships with suppliers and explore opportunities to optimize your supply chain.

- Customer Service: How satisfied are your customers? Collect feedback through surveys, reviews, and other channels. Address customer complaints promptly and effectively.

- Inventory Management (if applicable): Are you effectively managing your inventory levels to avoid waste and minimize storage costs?

Improving operational efficiency can free up resources, reduce costs, and improve your bottom line. The more efficient your LLC is, the more resilient it will be. Regular review of these operations directly impacts your LLC’s stability.

Risk Management: Preparing for the Unexpected

Every business faces risks. Proactive risk management involves identifying potential risks, assessing their likelihood and impact, and developing strategies to mitigate them. Consider these areas:

- Insurance Coverage: Do you have adequate insurance coverage to protect your LLC from potential liabilities, such as general liability, professional liability (if applicable), and property insurance?

- Cybersecurity: Are you taking steps to protect your business from cyber threats, such as data breaches and ransomware attacks? Implement strong passwords, use firewalls, and educate your employees about cybersecurity best practices.

- Business Continuity Planning: Do you have a plan in place to ensure your business can continue operating in the event of a disaster, such as a fire, flood, or pandemic?

- Legal Risks: Have you assessed potential legal risks, such as lawsuits or regulatory investigations?

- Market Risks: Are you aware of potential market risks, such as changes in consumer demand, competition, or economic downturns?

Risk management is an ongoing process. Regularly review your risks and update your mitigation strategies as needed. A well-defined risk management plan significantly contributes to your LLC’s stability.

Leadership and Management: The Driving Force

Strong leadership and effective management are essential for any successful LLC. Assess your leadership and management practices in the following areas:

- Leadership Style: Are you a decisive and effective leader? Do you provide clear direction and inspire your team?

- Communication: Do you communicate effectively with your team, customers, and stakeholders?

- Decision-Making: Do you make sound decisions? Are you able to gather and analyze information effectively?

- Teamwork: Does your team work well together? Do you foster a positive and collaborative work environment?

- Delegation: Do you delegate tasks effectively? Are you able to empower your team and trust them to handle responsibilities?

- Succession Planning: Do you have a plan in place for the future of your LLC, including succession planning for key roles?

Effective leadership and management are critical for navigating challenges and seizing opportunities. The quality of leadership directly impacts your LLC’s stability.

Adaptability and Innovation: Staying Ahead of the Curve

The business landscape is constantly evolving. Your LLC must be adaptable and innovative to survive and thrive. Consider these elements:

- Market Research: Do you regularly conduct market research to understand your target audience, industry trends, and competitive landscape?

- Product/Service Innovation: Are you constantly seeking ways to improve your products or services?

- Technology Adoption: Are you embracing new technologies to improve efficiency and gain a competitive advantage?

- Customer Feedback: Do you actively seek and incorporate customer feedback to improve your offerings?

- Strategic Planning: Do you have a long-term strategic plan that outlines your goals, strategies, and tactics?

Adaptability and innovation are essential for long-term success. Regularly evaluate your business model and strategies to ensure they remain relevant and competitive. This continuous process of self-assessment helps determine if your LLC is stable.

Taking Action: Improving Your LLC’s Stability

Once you’ve completed the self-assessment, it’s time to take action. Create a plan to address any weaknesses you’ve identified. Here are some steps to consider:

- Prioritize: Focus on the most critical areas first.

- Set Goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) goals.

- Create an Action Plan: Outline the steps you will take to achieve your goals.

- Allocate Resources: Determine the resources you will need, such as time, money, and personnel.

- Implement Your Plan: Put your plan into action.

- Monitor Progress: Track your progress and make adjustments as needed.

- Seek Professional Advice: Don’t hesitate to consult with professionals, such as accountants, attorneys, and business consultants.

Regularly revisit your self-assessment and action plan. The business environment is always changing, so you must be proactive in assessing and improving your LLC’s stability. This is key for the long-term health of your business. Implementing this self-assessment shows you care about the stability of your LLC.

Conclusion: Securing Your LLC’s Future

The stability of your LLC is not a fixed state; it’s an ongoing process. By regularly assessing your financial health, legal compliance, operational efficiency, risk management, leadership, and adaptability, you can proactively identify and address potential weaknesses. This self-assessment and improvement guide provides a framework for building a resilient and sustainable LLC. Remember that the long-term success of your LLC hinges on your commitment to continuous improvement and your ability to adapt to an ever-changing business environment. Ensure your LLC is stable by taking action today. The future of your business depends on it. [See also: Related Article Titles]