Affordable Off-Campus Housing: Leveraging the 529 Advantage

The college experience is a transformative period, a time of intellectual growth, social exploration, and, for many, the first taste of independent living. However, this exciting chapter often comes with a significant financial burden. Tuition, fees, books, and the ever-present cost of living can quickly become overwhelming. For students seeking a more independent lifestyle and potentially more affordable options, off-campus housing presents a compelling alternative. This article delves into the world of affordable off-campus housing and explores a powerful, yet often overlooked, financial tool: the 529 plan.

The rising cost of education has forced students and families to get creative in their financial planning. While on-campus housing offers convenience, it can sometimes be more expensive than off-campus alternatives. Finding affordable off-campus housing is a key concern for many students, and understanding the financial landscape is crucial. The 529 plan, primarily known for covering tuition, can also be utilized to make affordable off-campus housing a reality.

Understanding the 529 Plan

A 529 plan is a college savings plan sponsored by a state or educational institution. These plans offer significant tax advantages, making them a popular choice for families looking to save for higher education expenses. Contributions to a 529 plan are often tax-deductible, and earnings grow tax-free. Furthermore, withdrawals used for qualified education expenses are also tax-free at the federal level, and in some states. This makes the 529 plan a powerful tool for managing the costs of college.

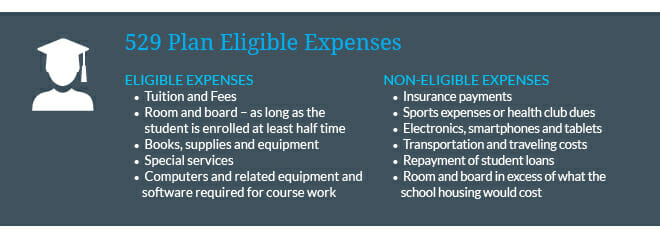

Qualified education expenses are the key to leveraging the 529 plan. These expenses typically include tuition, fees, books, and supplies. However, the IRS also allows for room and board expenses, which opens the door to using 529 funds for affordable off-campus housing. This is where the real potential of the 529 plan unfolds.

The Rules for Using 529 Plans for Off-Campus Housing

While the prospect of using 529 funds for affordable off-campus housing is appealing, there are specific rules and regulations that must be followed. Understanding these rules is crucial to avoid any potential tax penalties. The IRS has specific guidelines regarding what constitutes qualified room and board expenses.

- The Student Must Be Enrolled at Least Half-Time: To use 529 funds for room and board, the student must be enrolled at least half-time at an eligible educational institution. This is a fundamental requirement.

- The Housing Must Be Considered a Qualified Expense: The IRS defines qualified room and board expenses as those that are reasonable and necessary for the student’s attendance at the institution. This typically includes rent, utilities, and other essential living costs.

- The Amount is Limited: The amount of room and board expenses that can be covered by 529 funds is limited. It cannot exceed the school’s published room and board allowance for students living on campus. If the school doesn’t provide an allowance, the expense is limited to the actual amount spent.

- Documentation is Key: It’s essential to keep detailed records of all housing expenses, including rent receipts, utility bills, and any other relevant documentation. This documentation may be required if the IRS audits the 529 plan.

Adhering to these rules ensures that the withdrawals from the 529 plan remain tax-free and that the funds are used appropriately for educational purposes.

Finding Affordable Off-Campus Housing

Once the financial framework is in place, the next step is finding affordable off-campus housing. This requires careful planning and research. Here are some strategies to consider:

- Start Early: The best time to start searching for housing is often several months before the start of the school year. This gives students ample time to explore their options and secure a suitable place.

- Set a Budget: Determine a realistic budget based on the student’s financial resources and the availability of 529 funds. Consider all expenses, including rent, utilities, transportation, and food.

- Utilize Online Resources: Many online platforms specialize in connecting students with affordable off-campus housing. Websites and apps such as Zillow, Apartments.com, and local university housing portals can be invaluable resources.

- Network with Other Students: Reach out to current students and alumni for recommendations and insights into the local housing market. They may be able to provide valuable tips and leads.

- Consider Different Housing Options: Explore various housing options, including apartments, shared houses, and even co-living spaces. Each option has its own advantages and disadvantages in terms of cost, location, and amenities.

- Look for Deals and Discounts: Many landlords offer student discounts or special deals to attract tenants. Inquire about these opportunities when viewing properties.

- Factor in Transportation Costs: Consider the cost of transportation when choosing a location. Proximity to campus can significantly reduce transportation expenses.

By following these strategies, students can increase their chances of finding affordable off-campus housing that meets their needs and budget.

The Benefits of Off-Campus Housing

Choosing affordable off-campus housing offers several advantages over on-campus living.

- Increased Independence: Off-campus living provides students with a greater degree of independence and responsibility. They are responsible for managing their own living space, paying bills, and making their own decisions.

- Potentially Lower Costs: In many cases, off-campus housing can be more affordable than on-campus options, especially when considering the flexibility to choose different types of accommodation and the possibility of sharing expenses with roommates.

- More Space and Privacy: Off-campus apartments and houses often offer more space and privacy than dorm rooms, allowing students to create a more comfortable living environment.

- Greater Flexibility: Off-campus housing can provide greater flexibility in terms of location, amenities, and lease terms.

- Opportunity for Real-World Experience: Living off-campus can provide students with valuable real-world experience in managing their finances, maintaining a household, and interacting with the local community.

Maximizing the 529 Advantage for Affordable Off-Campus Housing

To maximize the benefits of using a 529 plan for affordable off-campus housing, consider the following strategies:

- Plan Ahead: Start saving early and contribute regularly to the 529 plan. This allows the funds to grow over time and provides more flexibility when it comes to covering housing expenses.

- Research the School’s Room and Board Allowance: Before withdrawing funds, research the school’s published room and board allowance to determine the maximum amount that can be covered by the 529 plan.

- Keep Detailed Records: Maintain meticulous records of all housing expenses, including rent receipts, utility bills, and any other relevant documentation. This is crucial for tax purposes.

- Coordinate with the School: In some cases, the school may be able to provide documentation of the student’s room and board expenses, which can simplify the process.

- Consider Other Financial Aid Options: Explore other financial aid options, such as scholarships and grants, to further reduce the overall cost of education and make affordable off-campus housing even more attainable.

- Consult a Financial Advisor: Seek professional advice from a financial advisor who can provide personalized guidance on managing the 529 plan and other financial matters.

By taking a proactive approach and carefully managing their finances, students can leverage the 529 plan to make affordable off-campus housing a reality.

Potential Challenges and How to Overcome Them

While the 529 plan offers a significant advantage, there are potential challenges to consider when using it for affordable off-campus housing. These challenges include:

- Documentation Requirements: The IRS requires detailed documentation of all qualified education expenses, which can be time-consuming and potentially burdensome.

- Compliance with IRS Rules: Strict adherence to the IRS rules is essential to avoid any potential tax penalties.

- Finding Affordable Housing: The local housing market can be competitive, and finding affordable off-campus housing may require significant effort and research.

- Managing Finances: Students may need to develop strong financial management skills to budget effectively and manage their housing expenses.

Here’s how to overcome these challenges:

- Stay Organized: Maintain a well-organized system for tracking and storing all housing-related documents.

- Understand the Rules: Familiarize yourself with the IRS rules and regulations governing 529 plans.

- Start Early: Begin the housing search process well in advance to increase the chances of finding affordable options.

- Seek Financial Guidance: Consult with a financial advisor or college financial aid expert for personalized advice and support.

Conclusion: Securing Affordable Off-Campus Housing with the 529 Advantage

Navigating the financial complexities of higher education can be daunting, but the 529 plan provides a powerful tool for managing costs, particularly for affordable off-campus housing. By understanding the rules, planning strategically, and taking advantage of available resources, students can create a comfortable and financially sound living situation. The flexibility and tax advantages of the 529 plan, combined with diligent financial planning, can make the dream of independent living and affordable off-campus housing a tangible reality. Remember to always verify information with the IRS and relevant tax professionals for the most up-to-date guidance.

The 529 plan offers a significant advantage in the pursuit of affordable off-campus housing. With careful planning and adherence to the guidelines, students can unlock financial flexibility and enjoy the benefits of independent living.

[See also: Related Article Titles]